Monday to Friday

9am to 5pm

If you’ve ever sat in a meeting where financial reports are discussed and felt completely lost, struggled to prepare a budget, or wondered how managers make sense of numbers so quickly — then it’s time to upgrade your financial skills. Understanding finance isn’t just for accountants. Whether you’re a manager, entrepreneur, or executive, being able to interpret financial information is an essential skill for making better decisions, managing risks, and standing out in today’s workplace.

From our Finance courses, you’ll learn how to read financial statements, build financial models, and apply financial analysis to real business cases. These skills aren’t just “nice to have” — they’re vital for anyone in business who wants to lead effectively, support growth, and communicate confidently with stakeholders.

| Finance | Normal Fees | Current Promotion |

|---|---|---|

| Finance for Non-Finance Professionals (2days) | RM 2450 | RM 1890 |

| Financial Modelling Essentials (2 Days) | RM 2350 | RM 1890 |

| Financial Modelling Intermediate (3 Days) | RM 2850 | RM 2450 |

| Financial Statement Analysis: Unleashing the Power of Numbers (2days) | RM 2350 | RM 1890 |

| Courses | Links |

|---|---|

| Finance for Non-Finance Professionals | Here |

| Financial Modelling | Here |

| Financial Statement Analysis: Unleashing the Power of Numbers | Here |

Business decisions today are increasingly tied to numbers. Without the right financial understanding, tasks such as approving projects, managing budgets, or analysing company performance can become guesswork.

That’s where our Finance courses come in.

By enrolling in CAD Training Centre’s finance courses , you’ll gain the ability to:

In short, finance skills make you more efficient, accurate, and effective — especially if your role involves planning, managing teams, or making business decisions.

Joining our Finance courses at CAD Training Centre gives you the ability to:

At CAD Training Centre, we offer a suite of Finance Courses tailored to different professional needs:

A beginner-friendly finance training that explains finance step by step. Learn how to read financial statements, interpret ratios, and connect numbers to real business decisions. You’ll also explore finance, credit analysis, and even career paths in finance.

What you’ll learn:

Recommendations:

Managers, entrepreneurs, HR, sales, project managers, operations, IT staff — anyone without a finance background but who needs to understand financial implications in their work.

A deep dive into financial statement analysis for those who want to go beyond the basics. Learn how to evaluate company health, performance, and risks through structured frameworks and analysis techniques.

What you’ll learn:

Recommendations:

Professionals in management, business owners, credit officers, analysts, and those considering investment or valuation roles.

Financial Modelling is one of the most in-demand skills for managers, executives, and analysts who need to make decisions backed by numbers. At CAD Training Centre, we offer both Essentials (2 Days) and Intermediate (3 Days) programs so you can choose the right level based on your experience.

Designed for those new to financial modelling, this course builds the foundation for understanding, creating, and analysing models in Excel. You’ll learn through SME and public listed company case studies, applying real-world data to hands-on exercises.

What you’ll learn:

Recommendations:

Professionals with basic Excel and finance knowledge who want to learn financial modelling for budgeting, analysis, or investment evaluation.

For participants ready to go further, the Intermediate course deepens your skills with advanced Excel tools, valuation techniques, and capital budgeting. Through multiple case studies, you’ll move from SME-level models to project finance models and multinational analysis.

What you’ll learn:

Recommendations:

Analysts, finance professionals, managers, and decision-makers who already understand the basics of Excel and finance, and want to develop robust models for investment, valuation, or project planning.

Every decision has a financial impact. The question is — do you understand it? With our Finance Courses, you’ll learn to analyse, forecast, and lead with confidence. Take control of the numbers today!

These Finance Courses are suitable for anyone who wants to build strong financial skills, whether you’re from a non-finance background, managing teams, or handling business decisions. If you are looking for specific areas that align with your role or career goals, here’s the suitability breakdown for each Finance Course in Malaysia.

Suitable for:

Suitable for:

Suitable for:

Suitable for:

❌ No upselling, no nonsense. With Finance Training you get pure Financial knowledge and how to put it into action in your company. This is a full 9am–5pm session — because honestly, 2–3 hour “crash courses” just won’t cut it if you want to really understand and implement properly.

✔️ Beginner-friendly. We start from zero, so you don’t need any prior background. Ask anything, anytime — our trainers are patient, approachable, and genuinely here to help you.

✔️ Walk away with a real strategy. Not just theory, but a practical plan you can use in your workplace the very next day. That’s what makes our Finance Courses different.

✔️ Certificate included. You’ll get something solid to show for your effort and commitment.

✔️ Free repeat classes (for face-to-face learners). We’d rather you really understand after attending, than rush through just for the sake of it.

✔️ Online learners? Don’t worry — you’ll get the class recording to revisit anytime you need a refresher.

🖥️ No laptop? No problem. We provide one during class so you can focus fully on learning.

📚 Complete training manual included. Everything in one place, step by step, so you won’t get lost after class.

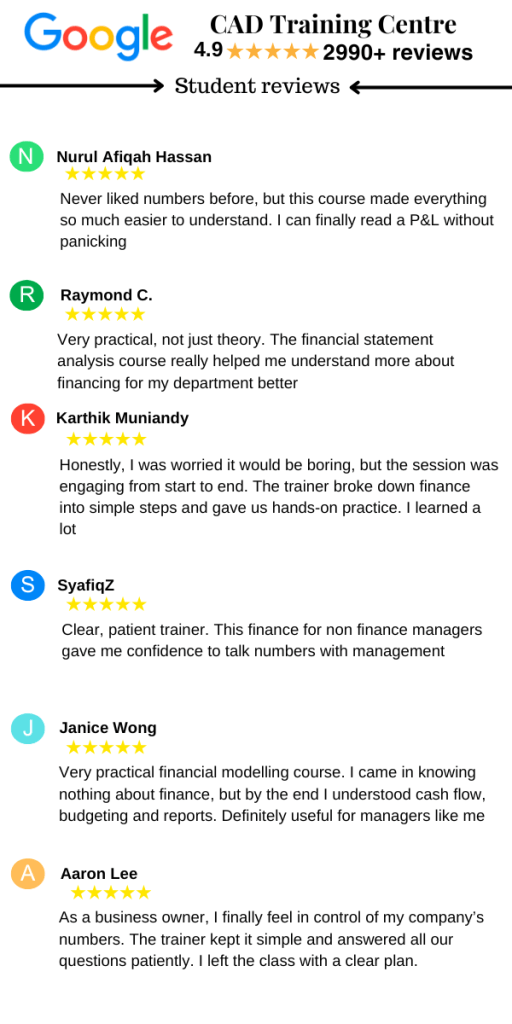

🌟 Proven track record. Over 2,400 glowing Google Reviews — CAD Training Centre is a trusted place to learn, and this Finance Course is no exception.

Our facility is situated in Bandar Puteri, Puchong and is just a 2-minute walk from the Bandar Puteri LRT.

There is also a parking complex that’s only a 3-minute walk to and fro our Training Centre, making sure that participants do not have to worry about taking a hike just to reach the CAD Training Centre. There are also numerous restaurants nearby, with options to match!

Our finance training sessions are held in a classroom setting. In our Finance Training, the instructor teaches the theory and shows various practical examples.

Participants also get to try out numerous exercises and experience the learning-by-applying concept.

The training style consists of 70% practical and 30% theory, workshop style. We intend that students learn more by doing rather than just listening.

You will receive personal guidance from our trainers during the class.

Our trainers will have Q&A sessions to answer the various questions throughout the class.

Our typical class size is between 6-10 students. This setup allows our trainers to spend more time with each of their students.

Our online Finance Courses are conducted via video conferencing platforms such as Zoom and Cisco Webex. Each class is bound to be both exciting and relaxed as our trainers have a lively approach that bodes well for online training. The lessons are also designed to promote ease of learning and with our experienced trainers, teaching and guiding students with practical hands-on exercises that are done via screen-sharing.

We offer in-house finance training in Malaysia based on the participants request. Our trainer will conduct the training in the location of your choosing.

Implementing Effective Business Finance Strategies: A Guide

6 steps to create your company’s financial plan

What Does Finance Mean? Its History, Types, and Importance Explained

The Importance of Financial Management

Are these courses HRDF Claimable?

Yes, all finance courses at CAD Training Centre are fully HRDF claimable under SBL-Khas. If your HR department needs assistance with the claim process, our team can guide you step by step.

Do I need a finance background to join?

Not at all. In our finance courses, Finance for Non-Finance Professionals is designed for complete beginners, with no accounting or finance background needed. For our other finance courses some basic Excel knowledge is helpful — but you don’t need to be an advanced user.

Will I receive a certificate after the course?

Yes, every participant will receive a Certificate of Completion after every finance course. This can be used for HRD Corp claims, professional development tracking, or adding to your career portfolio.

Are course materials provided?

Yes. You’ll receive a comprehensive training manual, practical case studies, and Excel templates depending on the finance course. For online courses, you’ll also receive the session recordings to revisit at your own pace.

What if I miss part of the course?

For physical finance training, you can join our Free Repeat Class option on future dates. For online learners, you’ll have access to the session recordings, so you don’t miss out on key learning.

How long are the courses?

Each program runs from 9:00 AM – 5:00 PM. Depending on the course:

What is the difference between Essentials and Intermediate Financial Modelling?

The Essentials program focuses on foundations: building basic models, ratio analysis, and valuation techniques. The Intermediate program adds advanced Excel tools, DCF and capital budgeting, project finance modelling, and scenario/sensitivity analysis.

Who usually attends these courses?

We get a mix of managers, executives, entrepreneurs, and professionals from HR, sales, marketing, operations, and IT. Anyone who interacts with budgets, reports, or financial decisions will benefit. We also see analysts and team leads who want to sharpen their financial analysis skills.

Can I still join if my role isn’t directly related to finance?

Yes. Even if you’re not in a finance role, understanding how numbers drive business helps you communicate better with management and make stronger decisions. Finance is the “common language” across all departments.

Do I need to bring a laptop?

No — we provide laptops during Finance Courses for physical sessions. For online participants, you’ll just need a computer.

Are these courses suitable for small business owners?

Definitely. Entrepreneurs and SME owners often find Finance for Non-Finance and Financial Statement Analysis especially helpful, as they give you tools to manage cash flow, budgeting, and business growth decisions confidently.

What if I have very little Excel knowledge?

That’s okay. For the Finance for Non-Finance and Statement Analysis courses, basic Excel is enough. For Financial Modelling, some comfort with Excel formulas (like SUM, IF, VLOOKUP) will make it easier — but the trainer explains step by step.

How practical are the courses?

All our courses use real-world case studies. You won’t just learn theory — you’ll practice reading statements, analysing ratios, and building models with guided examples. By the end, you’ll walk away with tools you can apply immediately at work.

Will these courses help me in my career progression?

Yes. Finance knowledge is one of the top skills managers and professionals need to move up. Whether you’re aiming for promotion, switching careers, or leading your own business, being financially literate sets you apart.

Are the trainers experienced?

Yes. All trainers are industry practitioners with years of experience teaching finance to non-finance audiences. They know how to simplify complex topics and make them relevant to your role.